Estate planning is a vital part of your financial plan. Therefore, it is crucial to spend thoughtful time developing a comprehensive plan to ensure your assets are distributed the way that you want them to be.

Planning ahead can give you greater control, privacy, and security of your legacy. If you own anything, it is a good idea to meet with your attorney and make plans to ease the administrative burden of your death on your family, provide protection for your children, and establish a plan in case of incapacity.

Estate plans are not only for the elderly. Everyone should have documents addressing what should happen in case of infirmity and death.

Prudent planning also gives you the opportunity to benefit from your charitable contributions and leave a lasting legacy. Estate planning does not have to be complicated, and the goal of this document is to guide you through what may at first seem like a daunting task.

Some questions to ask yourself to determine what you still need to do:

- Do you and your spouse each have a current will?

- Have you and your spouse developed an estate plan that would provide adequate income if you should survive your spouse by a number of years?

- Have you appointed a trusted financial decision-maker for financial decisions during your life?

- Have you changed the ownership of properties that passed to you?

- If your estate is large enough to be subject to estate taxes, have you taken steps to reduce those taxes?

- Have you appointed someone who knows your health care wishes if you cannot communicate them?

- Have you shared your health care desires with your health care decision-maker?

- Do your IRAs, life insurance policies, annuities, and other assets that pass by beneficiary designation reflect your current wishes?

- Does your current will or living trust provide for any charitable legacies?

- If you have provided for charitable legacies, do they reflect your current personal interests?

ACTION ITEM #1:

Finalize a will and consider a living trust

You can control over what happens to your assets after you die. Even if you are a person of modest means, you have an estate—and you have several strategies to choose from to ensure your assets are distributed according to your wishes and in a timely manner: your estate plan. The right strategy depends on your individual circumstances. For some, a living trust can be a useful and practical tool.

A will is a written document—signed and witnessed—that indicates how your property will be distributed at the time of your death. It is revocable and subject to amendment at any time during your lifetime. If you are currently married, you most likely own some things jointly with your spouse such as your residence, automobiles, and bank/brokerage accounts. If your spouse dies first, ownership of these items will pass automatically to you. You may also be the beneficiary of life insurance policies or retirement accounts. Any property not passed through joint ownership, by beneficiary designation or in trust, will be passed according to the terms of the will.

If you are widowed you should consult your attorney about updating your will. Most likely, there will be assets that you choose to redistribute. Also, it is important to make sure that all property that passed to you through your spouse’s will is properly titled. If you are divorced or remarried, you should make a new will to preserve your assets. On the other hand, if you have never married or had children, you should select an executor and beneficiaries of your assets.

Based on your circumstances, you may also consider establishing a living trust which provides lifetime and after-death property management. If you are serving as your own trustee, the trust instrument will provide for a successor upon your death or incapacity. Court intervention is not required. Livings trusts also are used to manage property. If a person is disabled by accident or illness, the successor trustee can manage the trust property. As a result, the expense, publicity, and inconvenience of court-supervised distribution of your estate can be avoided. If a living trust is properly written and funded you can:

- Avoid probate on your assets

- Plan for the possibility of your own incapacity

- Control what happens to your property after you are gone

- Use it for any size estate; and

- Prevent your financial affairs from becoming a matter of public record

- A living trust is more expensive to set up than a typical will because it must be actively managed after it is created. Most importantly, however, a living trust must be funded in that a living trust only can control those assets that have been placed into it. If your assets have not been transferred or if you die without funding the trust, the trust will be of no benefit as your estate will still be subject to probate.

To determine whether a will or living trust is right for you, analyze these key points:

- Wills are subject to probate, a court-supervised process that deals with your assets after you die. Living trusts are not subject to probate proceedings, and a trustee can immediately manage and distribute assets.

- Depending on your net worth and personal situation, a living trust may save your family money on estate and income taxes following your death.

- As opposed to wills, which become public information, living trusts do not go public.

ACTION ITEM #2:

Finalize a Durable Power of Attorney

A durable power of attorney enables a trusted person (or entity, such as a bank) to handle your affairs and make critical legal decisions in case you become mentally incapable. The core power of attorney gives someone the authority to act on your behalf and has three variations: General Power of Attorney, Limited Power of Attorney, and Medical Power of Attorney. The word “durable” attached to any of them means that the assigned power of attorney continues to be effective even if you become mentally incompetent.

You can opt to give someone power of attorney solely for health care decisions, and another who manages your financial affairs. Broad language giving an agent “all powers” to manage your financial affairs or make health care decisions may be enough for many purposes. But some powers are given only if they are specifically mentioned.

Those requiring specific mention include:

- The power to make gifts of your money or other property;

- The power to change your community property agreement; and

- The power to designate beneficiaries of your insurance policies.

Specifically authorized powers may be especially important for married people concerned about what would happen if one spouse became ill and needed nursing home care or other long-term care. Authority to transfer property from the disabled spouse to the healthy spouse may be important for Medicaid eligibility purposes. Note that some powers cannot be given to an agent, notably the power to make or alter a Will.

ACTION ITEM #3:

Finalize a Living Will

A living will is a document that explains whether or not you want to be kept on life support if you become terminally ill and will die shortly without life support, or fall into a persistent vegetative state. It also addresses other important questions, detailing your preferences for tube feeding, artificial hydration, and pain medication in certain situations. A living will becomes effective only when you cannot communicate your desires on your own.

You can make very specific details about your wishes in your living will. A copy should be given to the person you give power of attorney so that your wishes are clear. Be sure to consult your attorney when drafting your living will as the living will is referred to by different names and there are different forms that must be filled out depending on the state where you reside.

ACTION ITEM #4:

Plan your retirement income

Retirement is one of the biggest financial decisions you will ever make. When you or your spouse pass, you will want to ensure that you are financially safeguarded. What practical estate planning steps should you take now? When you meet with your financial advisor, ask:

- Will income from my spouse’s pension and/or Social Security decrease after my spouse’s death?

- How does my current estate plan provide financial security for the surviving spouse and/or other beneficiaries?

- Based on my income from retirement funds and investment funds can I spend each year without running out of money?

- I want to leave a legacy at a cause that is close to my heart. How do I establish a charitable gift annuity so that I can receive income for life?

ACTION ITEM #5:

Leave a Legacy through your Planned Giving

An important part of your estate planning is deciding how you would like to leave assets and create a collaborative relationship between yourself and a charitable organization. This form of donation is known as an endowment, legacy gift, or planned giving. Setting up an endowment in your Last Will is a good way for you to leave a personal legacy and support a cause that has meaning to you. There are many options for planned giving, so it’s useful to know what assets you can leave to charity and what type of donation will suit your financial position.

There are several common options in planned giving:

Options in Planned Giving

Many types of charitable gifts can be arranged to benefit both you and the charitable organization of your choice. Choosing the right planned gift depends on your personal circumstances and financial goals. You may have assets that could be used to produce income, or perhaps you own appreciated securities that could create a gift of significance in a way that is convenient and relatively inexpensive for you.

The following gift options may help you meet your own financial goals while also establishing your legacy.

Gifts Anyone Can Make

- Bequests: A bequest is a legal provision made by will or living trust. You may make a bequest or gift through your estate by including a provision in your will or living trust, by naming your chosen charitable organization as a beneficiary of a retirement plan or life insurance policy. The amount can be expressed as a specific dollar or as a percentage of the assets to be given.

- Gifts of Retirement Assets: You may reduce the size of your estate and potential income tax exposure to your heirs by naming your chosen charitable organization as a beneficiary of your retirement plan assets, such as your IRA or 401(K).

- Gifts of Life Insurance: You may transfer ownership of a paid up life insurance policy to a charitable organization or name them as a beneficiary. By doing so, you may receive an income tax deduction while making a gift using an asset you and your family no longer require.

- Donor Advised Funds: A donor advised fund allows you to make a tax-deductible gift to a charitable organization to establish a fund today, and later advise our organization on how you would like the gift used.

Gifts That Pay You Income

A life income gift allows you to give assets to a charitable organization while providing yourself or others with income for a period of time before that organization is permitted to use your gift. You may make a life income gift by transferring securities, cash, or other property to a charitable organization or a trustee. The organization or the designated trustee then manages the investment of the assets and pays an income to you, your designated beneficiaries, or both. Income payments continue for the beneficiaries’ lives or, in some cases, for a specified term.

There are several kinds of life income gifts available:

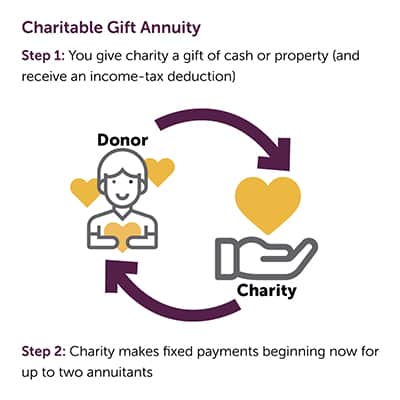

- Charitable Gift Annuities: In exchange for an outright gift, you can receive a fixed annual income for yourself and/or another beneficiary for life. This is a great way to supplement your retirement assets.

- Charitable Remainder Trusts: You establish a trust from which you and/or other beneficiaries receive variable annual payments for life and/or a term of years. At the end of the term, the remainder of the trust assets go to your designated organization for the purposes you designate. This trust can be funded with gifts of cash or appreciated securities, such as real estate or stock.

- Charitable Lead Trust: A charitable lead trust makes an annual payment to your designated organization for a period of years, and at the end of the term, the remaining assets go to your children or other beneficiary.

Which Planned Giving Option Will Work Best For You?

Refer to the following chart designed to guide you in selecting the best gift option to meet your financial and philanthropic goals and establish your legacy:

| GOAL | ACTION | BENEFIT |

|---|---|---|

| Secure a Fixed Income and Avoid Market Risks | Establish a charitable gift annuity | Income tax deduction and often a higher rate of income from assets |

| Defer a Gift During Your Lifetime | Designate your charitable organization as a beneficiary in your will or living trust | Estate tax deduction and maintained control of your assets during your lifetime |

| Maximize Heirs’ Inheritance While Benefiting Your Charitable Organization | Name your charitable organization as a beneficiary of your retirement plan, leave other assets to your family | Reduced estate and income tax |

| Make a Large Gift Incurring a Small Cost | Name your charitable organization as the beneficiary of an insurance policy you no longer need | Current and possible future income tax deductions |

| Create Income From Appreciated Real Estate or Marketable Securities | Establish a charitable remainder unitrust | Receive tax benefits and variable income stream for life |

| Pass Assets to Your Heirs Tax Free | Create a charitable lead trust | Reduce estate and gift taxes |